This expediency means that customers are paying their dues quickly, which can be a sign of an adequate credit and collections policy and solid customer creditworthiness. It’s a sign that a company has a healthy cash flow, enabling it to reinvest in the business, settle its obligations on time, and maintain a buffer against financial uncertainties. The average collection period ratio is an essential metric for businesses that rely on receivables for cash flow. The most recent data shows that 49% of B2B invoices produced in the U.S. become overdue. Regularly calculating your average collection period ratio can prevent each invoice you send from becoming a part of that statistic. Otherwise, if you allow clients to regularly take too long to pay invoices, your business may not have the cash on hand to operate how you’d like and meet financial obligations.

Company

Understanding the Metrics’ SignificanceAverage collection period measures the time it takes a company to collect payments from customers on credit sales. As AR is listed as a current asset in balance sheets, businesses rely on this metric to ensure they have enough liquidity to meet their short-term obligations. A lower average collection period implies more efficient collections and strong financial health, while a longer one may indicate potential issues with cash flow or customer payment practices.

Evaluate Credit Terms

The company may struggle to meet its financial obligations, potentially affecting its creditworthiness and ability to attract further investment. By the same token, the average collection period also provides insights into the effectiveness of the collections department. A longer collection period might indicate lax collection efforts, inefficient collections procedures, or poorly trained staff. On the other hand, a shorter average collection period not only signifies an efficient collections department but also a strong follow-up mechanism to ensure timely payment.

What does an average collection period of 30 days indicate for a company?

Generally, a good average collection period aligns with the credit terms a company extends to its customers. EBizCharge is proven to help businesses collect customer payments 3X faster than average. The ACP is a calculation of the average number of days between the date credit sales are made, and the date that the buyer pays their obligation. In this article, we explore what the average collection period is, its formula, how to calculate the average collection period, and the significance it holds for businesses.

How often should companies review their average collection period?

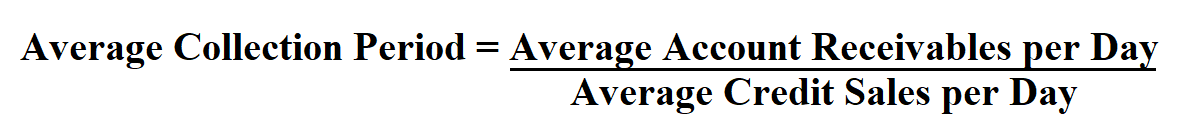

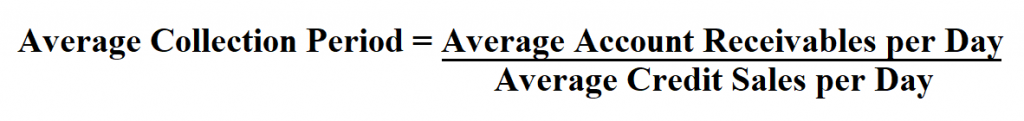

It is calculated by dividing the accounts receivable by the net credit sales and then multiplying the quotient by the total number of days in the period. It reflects the company’s liquidity and ability to pay short-term debts without depending on additional cash flows. The average collection period is a measure of how efficiently a company manages its accounts receivable. Generally, a smaller average collection period is more desirable as it indicates that the company gets paid promptly.

- By lowering your average collection period, your company will see significant improvements to your overall cash flow.

- External factors significantly impact the average collection period of an organization.

- Longer average collection periods can tie up a company’s cash in accounts receivable, potentially creating cash flow issues.

Accounts Payable Essentials: From Invoice Processing to Payment

It is also an indicator of the effectiveness of the accounts receivable policy and whether it needs to be updated. In gauging a company’s operational effectiveness, the average collection period plays a significant role. It is a reflection of how quickly a business collects its receivables, and therefore, how efficiently its operations are managed.

Automate Invoice ProcessesAutomating invoice processing can significantly reduce the time it takes for customers to receive and pay their invoices. Electronic invoicing, automated payment reminders, and real-time tracking can streamline collections and improve customer service. The best average collection period is about balancing between your business’s credit terms and your accounts receivables. For example, financial institutions, i.e., banks, rely on accounts receivable because they offer their customers credit loans, installments, and mortgages. A short and precise turnaround time is required to generate ROI from such services (you can find more about this metric in the ROI calculator). Thus, by neglecting their policies for managing accounts receivable, they can potentially have a severe financial deficit.

Lastly, offering incentives for prompt payments could motivate your clients to pay their bills faster, thus decreasing the average collection period. Using those hypotheticals, we can now calculate the average collection period by dividing A/ R by the net credit deals in the matching period and multiplying by 365 days. Businesses can forecast their collections scenario and adjust their spending planning by looking at the ACP. For instance, if a corporation has a 20 day old $500,000 AR balance with an average collection period of 25, it can anticipate receiving payment within a week. The concept of a “good” average collection period can vary significantly across different industries and companies.

This would show that your average collection period ratio of the year is around 46 days. Most businesses would aim for a lower average collection period due to the fact that most companies collect payments within 30 days. The average collection period, or ACP, refers to the amount of time it takes for a business to receive any payments that it is owed by its clients.

As such, it is acceptable to use the average balance of AR over the same period of time as covered in the income statement. Incorporating specialized software and tools designed for collection purposes can significantly enhance the efficiency of the receivables process. Automating the invoicing process ensures that bills are sent to customers promptly and consistently, which can accelerate payments. fill fate definition supply chain Automation reduces the chance of human error and minimizes the need for manual follow-up. Invoices reach the customers faster, and the system can be set up to send reminders, decreasing the average collection period. It’s essential that the selected time frame for the beginning and ending accounts receivable corresponds to the period for which you want to calculate the average collection period.